.png)

Digital transformation in fintech is reshaping services, customer connections, and daily operations. This growth offers opportunities for better, faster, and more customer-friendly approaches.

New technologies like AI, blockchain, and cloud are being widely adopted. They help financial firms simplify processes, cut costs, and boost security while ensuring stable operations.

This article explores the drivers, challenges, and benefits of this digital transformation in finance. It offers key insights for leaders in digital fintech startups, technology management, and product development to navigate and lead their company's digital evolution.

Why is digital transformation important for fintech companies?

For fintech companies, going digital isn't just a nice-to-have; it's how they stay competitive in a market. We've seen some big tech changes in finance like the growth of AI, cloud computing, APIs, and embedded finance. These things have changed how financial services work, making them more efficient, easier to use, and focused on the customer, creating long-term value.

One big reason digital fintech is going digital is what customers expect. People now want services right away, smooth experiences, and easy access to financial tools on their phones.

For example, mobile banking has made people expect services that are always available and easy to use. So, fintech companies need to make sure their platforms are not just user-friendly but also safe.

The push from traditional banks to update their services is also driving changes, with solutions like B2B payment API integrations helping streamline processes. Older banks are increasingly using digital tools to stay relevant, especially with the rise of newer banks (Revolut) that offer quick, customer-focused products. Fintech companies are benefiting from this shift because they can innovate faster, offer better user experiences, and use technology to grow quickly – including through stablecoin payment solutions - something traditional banks often struggle with.

Also, the competition is tough, and fintech companies that don't keep up with new technologies risk falling behind.

For instance, companies like Stripe have changed how online payments work by offering an easy-to-add tool that lets businesses accept payments smoothly. Similarly, embedded finance, which lets companies add financial services to their own platforms, is becoming popular, giving fintech companies more ways to serve customers.

Another big reason for digital transformation is pressure from regulators. With stricter rules in the financial world, fintech companies need to be flexible and make sure their operations follow both local and global standards. This has created a need for systems that can grow, are flexible, and can quickly adapt to new rules.

Actually, studies show that most banks have a digital plan, but not many are doing it well. This gap is a big chance for fintech companies to become leaders by fully embracing digital transformation.

Shortly, digital transformation in finance is driven by what customers want, competition, and the need to grow and follow rules. Successful companies like Revolut and Stripe are showing that embracing new technology can lead to a lot of growth and a bigger share of the market.

Common challenges in fintech modernisation

Fintech companies looking to go digital often run into some big roadblocks. Even though going digital can lead to better efficiency and more growth, it's usually not a simple process.

Here are some of the common challenges these companies face face:

✓ Legacy systems or fragmented tech stacks

A major hurdle for fintech companies is outdated or fragmented technology. Many long-standing firms still rely on old systems, which hinder integration with new technologies and scalability. These systems often can't support advanced features like real-time processing or AI, making it difficult to decide whether to update or replace them without disrupting business.

✓ Scalability issues during growth

As fintech companies grow, they often struggle to handle increased transactions, users, and features. Weak systems can lead to slowdowns, delays, or outages. Without planning for scalability, such as using cloud technology or modular designs, they risk service disruptions and falling behind competitors.

✓ Regulatory compliance complexities

It's no secret that the financial world is one of the most regulated industries around the globe. Fintech companies have to carefully deal with rules that are not only complicated but also constantly changing. What makes it even trickier is that these regulations often look different depending on the country or region, which adds extra complexity for companies that want to do business internationally.

Making sure they follow data privacy laws, rules against money laundering (AML), and the 'Know Your Customer' (KYC) process takes a lot of investment in technology and people. If they don't comply, fintech companies could face big fines, legal trouble, or even be forced to stop operating. This makes keeping up with regulations a continuous challenge for them.

✓ Hiring and tech talent bottlenecks

Fintech companies also run into trouble when trying to modernise because there simply aren't enough skilled tech people around. Since going digital depends so much on things like AI, ML, and blockchain, there's a constant need for developers, data experts, cybersecurity specialists, and other tech professionals. It's a real competition to find these people, and lots of fintech firms have a hard time hiring the right ones. This lack of talent can slow down the creation of new products, make it tough to get good tech support, and cause delays in putting new technologies into practice.

How Patternica supports fintech digital transformation

At Patternica, we focus on helping fintech companies successfully adapt to the digital finance world. We offer solutions that allow them to grow smoothly, operate efficiently, and meet all the regulations, while keeping a user-centric approach in mind.

How we support our fintech clients:

→ Cloud-native software development

We build scalable, reliable cloud platforms that grow with your business. Our cloud solutions ensure high availability and handle increasing transactions, helping fintech companies expand smoothly. For example, we set up a secure cloud-based payment system, speeding up transactions and enhancing user experience.

→ API integrations

For fintech companies, smooth integration of software systems is crucial. At Patternica, we ensure payment systems, KYC, AML checks, and other services work seamlessly together, helping fintech firms operate efficiently and comply with international regulations. We recently assisted a German fintech startup in expanding their team and improving system connections, speeding up their product launch.

→ Custom fintech platforms

We create custom fintech platforms tailored to each client's needs, including payment systems and mobile banking apps. Our goal is to deliver user-friendly solutions that help clients achieve their business objectives and offer innovative services to their customers.

→ AI & data-driven development

We leverage AI and data to create smarter fintech solutions, like automated credit scoring and fraud detection. For a German AI fintech startup, we helped scale their team and develop AI-powered products, enabling smooth expansion and innovative services for their customers.

→ Regtech & compliance

We provide tech solutions to help fintech companies stay compliant with regulations like GDPR, PSD2, and KYC/AML, ensuring they meet legal and security requirements while innovating.

Need expert help now?

Contact UsThe future of fintech: key trends

The fintech industry is evolving rapidly, and staying competitive requires keeping up with emerging trends. Here are key developments shaping the future of finance.

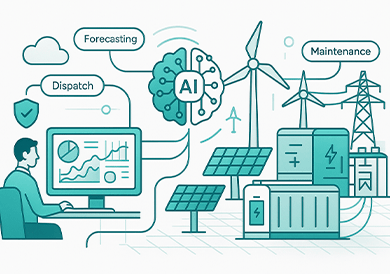

• AI and ML in finance

AI and ML are transforming finance by enabling better decision-making, automation, and personalized experiences. From stock trading algorithms to fraud detection and personalized advice, AI helps fintech companies offer faster, more precise, and secure services. It allows them to analyze data, predict trends, and manage risks, driving financial innovation.

• Cloud-native development and microservices

Fintech companies are really changing how they build and launch their apps by using what's called cloud-native development. One key part of this is using microservices, which helps them create systems that are more adaptable, can grow easily, and are simpler to manage.

Cloud-native platforms also make it possible to release updates quickly and scale up their systems faster. This is crucial for fintech firms because they need to be able to respond quickly to changes in the market. Plus, this method makes their systems more reliable. If one part has an issue or gets really busy, the other parts can keep running smoothly.

• APIs and open banking

APIs are really central to how financial technology is changing. They allow different financial services and other platforms to connect smoothly. For example, open banking uses these APIs so you can securely share your financial information with other companies. This is leading to new and tailored financial products just for you.

This trend is encouraging different players in finance – fintech companies, banks, and startups – to work together. This pushes innovation and gives people more choices. Open banking is likely to keep expanding as more rules, like PSD2 in Europe, push banks and other financial institutions to open up their data to authorised third parties.

• Blockchain and DeFi

Blockchain and decentralised finance, or DeFi, are likely to change how traditional finance works. Blockchain lets people make direct transactions without needing middlemen, which can make things more transparent, secure, and faster.

DeFi platforms use blockchain to offer alternatives to regular banking services, like lending, borrowing, and trading. These platforms are growing quickly and can help people and businesses who haven't always been well-served by traditional banks access financial services.

As more people start using blockchain and DeFi, it's probable that financial services will be delivered differently, becoming more accessible and efficient for everyone.

• Personalised finance and data analytics

More and more, financial companies are using data analysis to offer services designed just for you. By looking closely at how each customer manages their money and what they need, these companies can create things like custom investment plans, budgeting help that fits your life, and savings goals tailored to you.

This move towards making things personal is really driven by improvements in how we analyse large amounts of data. This helps companies understand what you might like, predict what you might do in the future, and give you more helpful advice right when you need it.

Since customers now expect services that feel like they were made for them, financial technology companies need to use data effectively to stay ahead.

Why choose Patternica for fintech digital transformation

For fintech companies that want to stay ahead in today's digital finance world, going digital is really important. The financial industry is changing fast, with new things like AI, cloud technology, blockchain, and open banking. Fintech businesses need to adapt quickly to what customers expect and the rules they need to follow. Using these technologies can make things more efficient, help them grow, and lead to new ideas. This gives them a big advantage over older, more traditional banks and financial services.

At Patternica, we know the special problems fintech companies face when they're trying to go digital. We offer solutions made just for them, like building software for the cloud, making different systems work smoothly together with APIs, and using AI in their platforms. Everything we do is designed to fit what fintech companies need. Our team of experts helps these businesses update their systems, make sure they're following all the rules, and improve how customers experience their services. All of this helps them grow in a lasting way.

We've worked on many successful fintech projects, like growing teams, building platforms, and connecting payment systems. Because of this experience, Patternica is a great partner to help you navigate the tricky parts of going digital. We help fintech companies not just use new technologies, but also use them to come up with new ideas and become leaders in the market. This makes sure their approach to financial services is ready for the future.

Choosing Patternica means you'll have a partner you can trust. We're dedicated to helping your fintech business succeed and thrive in this fast-moving digital age.

FAQ

What does digital transformation mean in the fintech industry?

When we talk about digital transformation in the financial world, it means using new technologies like artificial intelligence, cloud computing, blockchain, and APIs. The goal is to make financial services work better, handle more growth, provide a better experience for customers, and keep everything secure.

How long does digital transformation typically take for a fintech company?

How long a digital transformation takes really depends on what a company wants to achieve and how complicated the project is. It could be a few months, or it might take a couple of years. Things like the company's goals, their current systems, and what resources they have all play a big role in the timeline.

What technologies are driving digital transformation in fintech?

Several important technologies are fueling the digital changes we're seeing in financial technology (fintech). These include things like artificial intelligence (AI), machine learning, blockchain, cloud computing, APIs, and open banking. Basically, these technologies allow fintech companies to provide services that are faster, more tailored to individuals, and more secure.

How can Patternica help with fintech digital transformation?

Patternica helps fintech companies with their technology needs. We offer modern cloud development, connect different systems using APIs, build smart platforms powered by AI, and provide solutions to meet industry regulations. Our goal is to help these businesses grow, come up with new ideas, and deliver secure financial services that are ready for the future.

How does digital transformation impact compliance and security in fintech?

Going digital helps fintech companies stay compliant and secure in a big way. By using automated systems, they can handle things like verifying customer identities (KYC), preventing money laundering (AML), and spotting fraud much more effectively. This also means they can monitor things as they happen, keep data safe, and follow all the important rules around the world. Ultimately, this lowers the risks for these companies.

.png)

.png)